AI-Powered Next Gen Indicator and Strategy

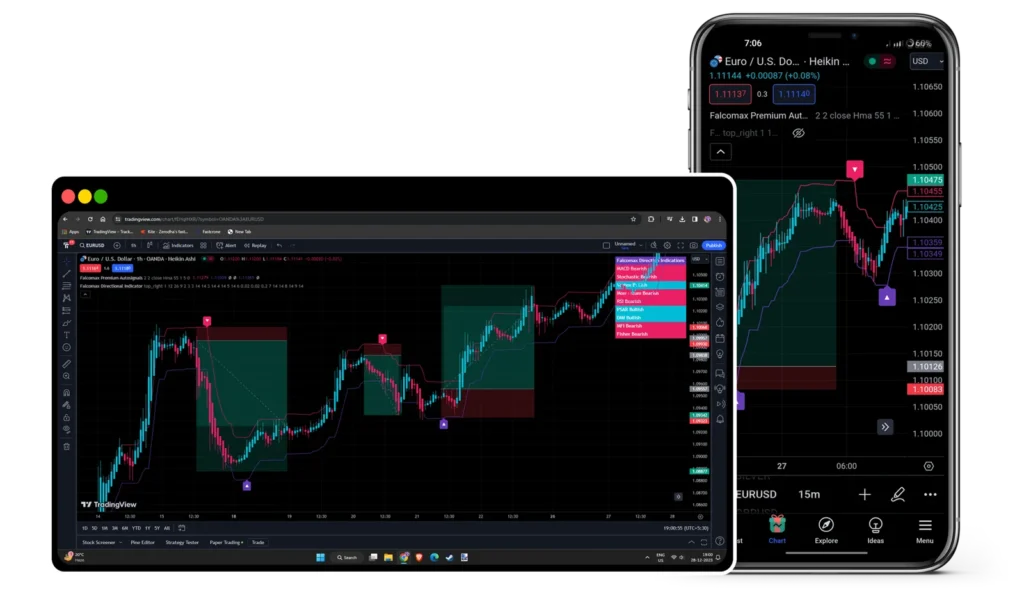

Want to make money trading futures or options, but don’t have a strategy? Not knowing when to enter and exit the market? We got you! With an indicator made for swing and positional trading. Trading has never been this easy, real-time signals.

Top Traded Instruments With Options BlackBox Strategies

- Loading stock data...

Rarealgo Strategies

Smart Waves

- BUY-SELL Signals

- Backtesting on 15 years of data with ability to customize settings

- Futures trading, option buying & option selling

- Indices, stocks, forex, crypto & commodities

- Suitable for traders

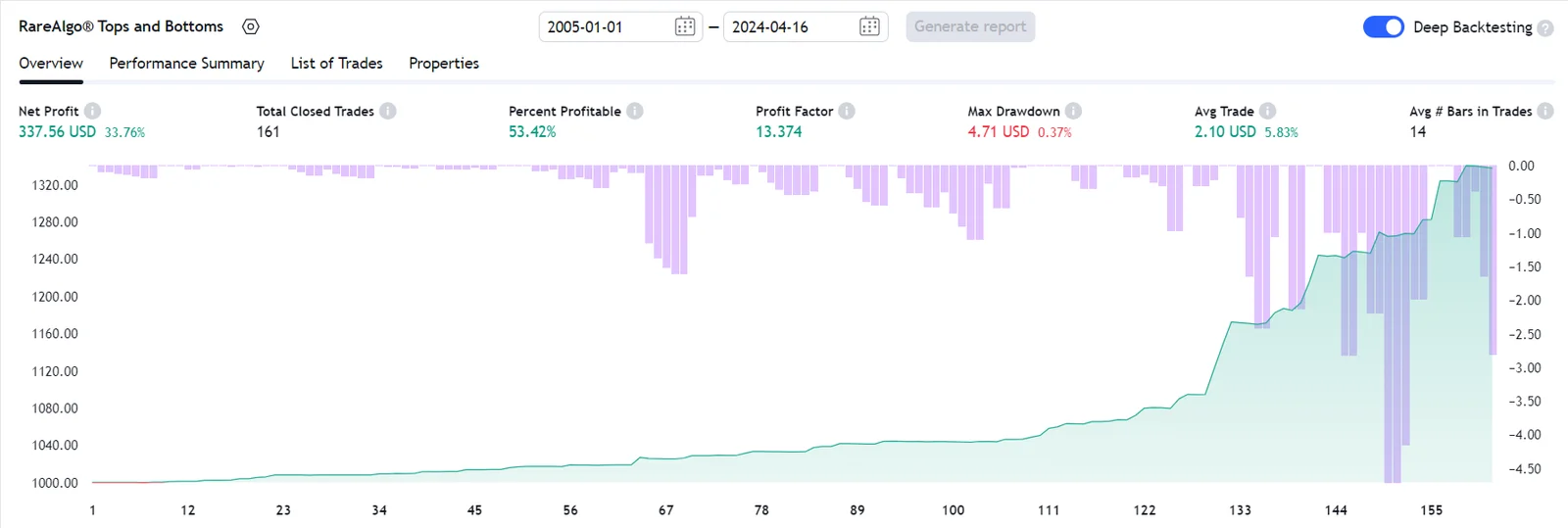

Tops & Bottoms

- BUY-SELL Signals

- Backtesting on 30 years of data with ability to customize settings

- Equity long only strategy

- Suitable for Investors

- Identifying near market tops and bottoms

Self Verified Track Record

While other companies may claim to be the best, we can actually back up our boasts with evidence. Our track record speaks for itself, showing a clear and consistent history of success that sets us apart from the competition. We pride ourselves on our verified track record of exceptional results. Unlike other companies that make promises without the proof, our success is clear and verifiable. With tradingview’s strategy tester tool and with the help of deep backtesting, you can verify the results at your end with a single click.

Futures & Options Trading Just Got A- New Meaning

Our institutional-grade trading strategies completely redefines conventional stock trading. With every instrument deep backtested on over 15 years of data, its the most advanced and simplest of strategies that you will get in market!

Futures & Options Trading Just Got A- New Meaning

Our institutional-grade trading strategies completely redefines conventional stock trading. With every instrument deep backtested on over 15 years of data, its the most advanced and simplest of strategies that you will get in market!

Benefits Of Using Rarealgo

Strategies To Help You Trade Better

Lorem ipsum, or lipsum as it is sometimes known, is dummy text used in laying out print, graphic or web designs. The passage is attributed to an unknown typesetter in the 15th century who is thought to have scrambled parts of Cicero’s De Finibus Bonorum et Malorum for use in a type specimen book.

The passage experienced a surge in popularity during the 1960s when Letraset used it on their dry-transfer sheets, and again during the 90s as desktop publishers bundled the text with their software.

No Repaint

Lorem ipsum, or lipsum as it is sometimes known, is dummy text used in laying out print, graphic or web designs. The passage is attributed to an unknown typesetter in the 15th century who is thought to have scrambled parts of Cicero’s De Finibus Bonorum et Malorum for use in a type specimen book.

The passage experienced a surge in popularity during the 1960s when Letraset used it on their dry-transfer sheets, and again during the 90s as desktop publishers bundled the text with their software.

Designed For Traders, By Traders

Lorem ipsum, or lipsum as it is sometimes known, is dummy text used in laying out print, graphic or web designs. The passage is attributed to an unknown typesetter in the 15th century who is thought to have scrambled parts of Cicero’s De Finibus Bonorum et Malorum for use in a type specimen book.

The passage experienced a surge in popularity during the 1960s when Letraset used it on their dry-transfer sheets, and again during the 90s as desktop publishers bundled the text with their software.

Advantages Of Using Our Services

Our trading robots use mathematical models and advanced algorithms to analyze market data and make investment decisions. They are programmed to follow a set of rules and give trade signals based on market conditions. They continuously monitor the market and identify opportunities without any human emotion.

01. Quality Over Quantity

Instead of overwhelming you with 1000 metrics, we focus on metrics that matter and metrics that are meaningful.

02. Turn Confusion Into Clarity

Find convergence in every trade with our indicators designed for any market. Works on any device and it’s all real-time data.

03. In-built Buy and Sell Signals

Enhance your trading journey with super trading systems made by Options Blackbox team. Make trading simplified and easy.

Our Plans & Pricing

Four Step Process

What’s Our Clients Says?

One of the few companies to give indicator in the form of strategy which one can backtest on trading view strategy tester. Lots of settings to play with and a good customer support team.

Prad J

DOR: August 19, 2023

Looks good on backtesting using their strategies. Lots of permutations and combinations to be explored.

Marcus Patel

DOR: February 08, 2024

The 'RareAlgo' TradingView indicator is designed with user-friendliness in mind, catering to traders of all levels. It stands out by providing recommended settings on its website for numerous instruments.

Danny Coleman

DOR:December 01, 2023

Exceptional backtesting platform! Offers diverse strategies and excellent support. Perfect for traders seeking versatility and profitability.

Asrif Mandes

DOR: January 07, 2024

What We Have To Say

Dear Trader,

We know you have tried many courses, webinars and seminars to become a profitable trader. Endless YouTube videos and Instagram ads have overwhelmed you with a lot of data without knowing where exactly to start. With many experts just focusing on support/resistance levels or price action, most of you don’t have a strategy that will consistently make you money. Add to it poor risk management, lack of education and research, overtrading, emotional decision making etc. and the journey has been painful.

With Optionsblackbox, you get access to our very own proprietary indicator and strategies. We also guide you with position sizing so that you make consistent money without overleveraging and not succumbing to your emotions. Our strategies give you exact entry-exit signals, so it requires no human intervention and are completely mechanical. Backtested on over 15 years of data, it gives you the confidence to completely rely on the strategies irrespective of market volatility or any other external factors. We hereby invite you to try our no lag, no repaint, on bar close strategies and trade the markets with confidence by becoming a blackbox systems trader.

-Team Options BlackBox

Self Verified Track Record

While other companies may claim to be the best, we can actually back up our boasts with evidence. Our track record speaks for itself, showing a clear and consistent history of success that sets us apart from the competition. We pride ourselves on our verified track record of exceptional results. Unlike other companies that make promises without the proof, our success is clear and verifiable. With tradingview’s strategy tester tool and with the help of deep backtesting, you can verify the results at your end with a single click.

Outperforming Top Investment Assets

Frequently Asked Questions (FAQ)

Backtesting involves testing a trading strategy using historical data to evaluate its performance. It's crucial because it helps traders assess the viability of their strategies before risking real capital. By simulating trades on past market conditions, traders can identify flaws, optimize parameters, and gain confidence in their approach.

Common pitfalls in backtesting include over-optimization, data snooping bias, and neglecting transaction costs. Avoid curve-fitting by testing your strategy on multiple datasets and using realistic assumptions. Be mindful of survivorship bias and ensure your data includes all relevant assets and time periods. Factor in slippage, commissions, and other trading costs to obtain a more accurate representation of real-world performance.

To interpret backtesting results, focus on key metrics such as profit and loss, win rate, maximum drawdown, and risk-adjusted returns. Analyze the equity curve, trade frequency, and performance during different market conditions. Consider conducting sensitivity analysis to assess the strategy's robustness to variations in parameters or market conditions. Ultimately, aim for consistency and stability in performance rather than solely maximizing returns.

To enhance profitability, focus on optimizing risk management, entry/exit criteria, and position sizing. Analyze backtesting results to identify areas for improvement and refine your strategy accordingly. Consider incorporating multiple timeframes and market conditions into your testing to increase adaptability.

To avoid overfitting, simplify your strategy, use robust validation techniques, and test on out-of-sample data. Avoid excessive parameter optimization and prioritize simplicity and generalizability over complexity.